Small business acquisition can feel like stepping into an entirely new earth. Irrespective of whether you’re a little business enterprise operator eyeing a bigger organization or a considerable Company planning to grow, comprehension the ins and outs of this method is vital. It's actually not nearly the economic transaction; It is about growth, strategy, and eyesight. But why would any individual want to accumulate a business? Perfectly, it's possible you're looking to broaden your market access, achieve new clients, or leverage A further firm's strengths. No matter what your reason, there’s quite a bit a lot more to it than simply producing a Check out. Let’s crack it down.

Take into consideration company acquisition to be a marriage. You’re not just getting assets or staff members; you’re merging two cultures, two ways of imagining, and two sets of values. This process demands a ton of study, very careful thought, and some critical commitment. What takes place if you don’t do your homework? That’s when complications come up. You could possibly end up getting a company that doesn’t align together with your aims or one that drags down your income. So, before you make any choices, it’s essential to conduct research and absolutely comprehend Whatever you’re stepping into.

A Biased View of Business Acquisition

Once we take a look at due diligence, we’re discussing diving deep into each facet of the business enterprise. Financials? Examine. Legal matters? Double-Look at. You’ll want To guage everything from the business’s equilibrium sheets to their personnel contracts. You wouldn’t purchase a home with no an inspection, ideal? Identical basic principle applies here. By making certain just about every element is accounted for, you’re minimizing chance and making sure that you’re producing a audio investment. With out this, you could possibly end up having extra surprises than you'd like, and believe in me, no-one likes terrible surprises in small business.

Once we take a look at due diligence, we’re discussing diving deep into each facet of the business enterprise. Financials? Examine. Legal matters? Double-Look at. You’ll want To guage everything from the business’s equilibrium sheets to their personnel contracts. You wouldn’t purchase a home with no an inspection, ideal? Identical basic principle applies here. By making certain just about every element is accounted for, you’re minimizing chance and making sure that you’re producing a audio investment. With out this, you could possibly end up having extra surprises than you'd like, and believe in me, no-one likes terrible surprises in small business.Attaining a business isn't nearly acquiring a lot more buyers; it’s also about getting mental house, technological innovation, or perhaps a model name. For illustration, if you’re in the tech industry, attaining a lesser business with groundbreaking know-how could place you miles forward of one's Opposition. Or maybe it’s about moving into a completely new geographic current market wherever that organization presently features a foothold. These belongings is often priceless in assisting your business improve and compete on a larger scale. It’s a strategic Enjoy that, when accomplished proper, can change the overall trajectory of your small business.

Financing the acquisition is yet another beast in by itself. You will find various strategies to fund a business acquisition. You could possibly go the traditional route and protected a bank personal loan, or you might explore far more Imaginative funding alternatives like vendor financing or perhaps a leveraged buyout. Seller funding is when the vendor lets you buy the enterprise over time, very similar to a property finance loan. Leveraged buyouts, Alternatively, utilize the acquired firm's belongings as collateral for any financial loan to fund the purchase. Every single has its own Rewards and threats, and choosing the appropriate one is determined by your money situation and the size with the acquisition.

Little Known Facts About Business Acquisition.

Lifestyle clash has become the most vital worries during an acquisition. Envision merging two groups of staff that have distinct operate variations, leadership expectations, as well as Workplace behavior. How can you maintain the ship afloat when there’s turbulence among the crew? The solution is interaction. Appropriate from the start, it’s essential to engage both of those sets of workforce, tackle their worries, and set up a unified culture. This may be among the list of trickiest areas of the process, but it’s also One of the more important. With no worker get-in, The mixing of the two companies can falter.

Lifestyle clash has become the most vital worries during an acquisition. Envision merging two groups of staff that have distinct operate variations, leadership expectations, as well as Workplace behavior. How can you maintain the ship afloat when there’s turbulence among the crew? The solution is interaction. Appropriate from the start, it’s essential to engage both of those sets of workforce, tackle their worries, and set up a unified culture. This may be among the list of trickiest areas of the process, but it’s also One of the more important. With no worker get-in, The mixing of the two companies can falter.Negotiating the deal is the place items can get powerful. This is when you sit down with the seller and hammer out the main points, from acquire value to how the transition will unfold. It’s a delicate dance. You wish to get the very best offer attainable, but at the same time, you don’t choose to sour the connection before the ink is even dry. An excellent negotiator knows when to thrust and when to pull back again. Getting professional advisors, whether they’re legal professionals, accountants, or brokers, could make all the primary difference in securing favorable terms.

As soon as the acquisition is finalized, the real get the job done begins—integrating the two providers. This is where quite a few offers go from the rails. Successful integration needs a apparent program and powerful leadership. It’s about aligning operations, programs, and groups whilst reducing disruption into the enterprise. This is certainly no quick feat, particularly if the obtained company operates in a distinct marketplace or market. The combination approach normally takes months, if not a long time, to finish thoroughly. Tolerance and adaptability are important to ensuring the acquisition pays off In the long term.

Timing is all the things in business acquisitions. In the event you rush into a deal, you could possibly forget important aspects. On the other hand, in the event you wait as well lengthy, a competitor may snatch up the opportunity. It’s a website balancing act. Understanding when to produce your transfer requires a deep understanding of the market, the target enterprise, plus your have business enterprise abilities. A properly-timed acquisition can provide you with a competitive edge, but timing it poorly can be a costly oversight. Recall, buying a business isn’t a race—it’s a marathon.

Why do lots of acquisitions fall short? One particular significant reason is usually that prospective buyers overpay. They get caught up while in the excitement of your offer and wind up spending in excess of the organization is really worth. This is when valuation comes in. Valuing a company is more art than science. Guaranteed, it is possible more info to take a look at earnings and earnings margins, but other factors like model strength, current market place, and opportunity for foreseeable future growth Enjoy a big purpose. An accurate valuation makes certain you’re paying a good price and never location oneself up for economical strain down the line.

Lawful hurdles are an inevitable Section of any business acquisition. From contracts to compliance with regulatory demands, there’s loads of paperwork concerned. You’ll require a good legal crew to guideline you through the method and Guantee that every thing is earlier mentioned board. Pass up a step listed here, and you could possibly be facing lawsuits or fines afterward. It’s a cumbersome course of action, but one which’s necessary to safeguard equally you and the vendor. Dotting each individual “i” and crossing each individual “t” in the legal realm ensures that the transition takes place efficiently.

Don’t ignore buyer retention. Any time you receive a company, you’re also attaining its shopper foundation. But will Those people prospects adhere all-around write-up-acquisition? Prospects can be cautious when their dependable manufacturer is absorbed by a bigger entity. It’s vital that you reassure them which the services they enjoy aren’t heading to alter—at the very least not in ways that negatively impact their experience. Speaking with prospects all over the acquisition approach can assist sustain loyalty and prevent churn.

How Business Acquisition can Save You Time, Stress, and Money.

What about the vendor? Their involvement put up-acquisition could be a game-changer. Sometimes, maintaining the vendor on board for any changeover period of time is extremely precious. They know the enterprise inside of and out and will help guide you through those 1st few months. Whether they continue to be on like a consultant or just take A short lived executive purpose, their insights can smooth the transition and continue to keep items functioning smoothly. In addition, it reassures employees and consumers that somebody familiar continues to be at the helm throughout the transition.Expansion through acquisition is a typical tactic, specifically for businesses planning to scale immediately. Rather than constructing from the bottom up, you’re attaining an currently-proven organization with its have customer base, items, and infrastructure. Nonetheless it’s not generally sleek sailing. You must make sure that the acquired enterprise matches using your Over-all system. If not, you risk diluting your brand or straying too far from your Main competencies. It’s vital to Examine how The brand new small business aligns with all your very long-time period aims.

Model status is an additional crucial thought. In the event the company you’re obtaining has a great reputation, that’s An important earn. But what when they’ve had some PR disasters? You don’t want to inherit lousy push along with the business. It’s imperative that you evaluate not only the financial health and fitness of the corporate but in addition how it’s perceived by read more the general public. A powerful manufacturer status could be a significant asset, when a tarnished a single can cause complications For many years to come back.

Occasionally, a business acquisition is about doing away with Competitiveness. Acquiring a rival corporation will help you corner the industry and reduce the aggressive pressures on your enterprise. But be mindful—antitrust legal guidelines are meant to avoid providers from turning out to be monopolies, and regulators could possibly stage in whenever they think your acquisition is stifling Competitiveness. Normally seek advice from with authorized experts to make certain that your offer doesn’t operate afoul of these rules.

What comes about if the acquisition doesn’t go as planned? It’s not unusual for promotions to fall apart, either for the duration of negotiations or once the transaction is complete. If items start to go south, it’s essential to have an exit strategy in place. Regardless of whether Which means going for walks clear of the offer entirely or renegotiating terms, getting versatile can help you save from the terrible problem. Remember, occasionally the very best offer is the 1 you don’t make.

Some Known Questions About Business Acquisition.

Business acquisition is actually a Software—1 which can be wielded for enormous growth or bring about unpredicted difficulties. It’s about a lot more than simply revenue altering fingers; it’s about aligning ambitions, merging cultures, and making sure the future achievement of equally corporations. With the ideal method, you'll be able to leverage acquisition to just take your business to new heights. But it really’s not a silver bullet. Like several tool, it must be employed thoughtfully, with care and precision.

Ultimately, getting a business is about possibility. It’s about viewing likely the place Some others may not and acquiring the bravery to go ahead and take leap. Confident, you can find pitfalls concerned, but with the correct method and preparation, those risks can be managed. So, irrespective of whether you might be pondering buying a small nearby business or simply a multinational enterprise, bear in mind the acquisition approach is just the beginning. The actual results arises from Everything you do once the offer is done.

Michelle Pfeiffer Then & Now!

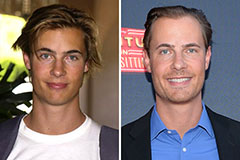

Michelle Pfeiffer Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!